Profit & Loss Statement for Business

- 25 October 2023

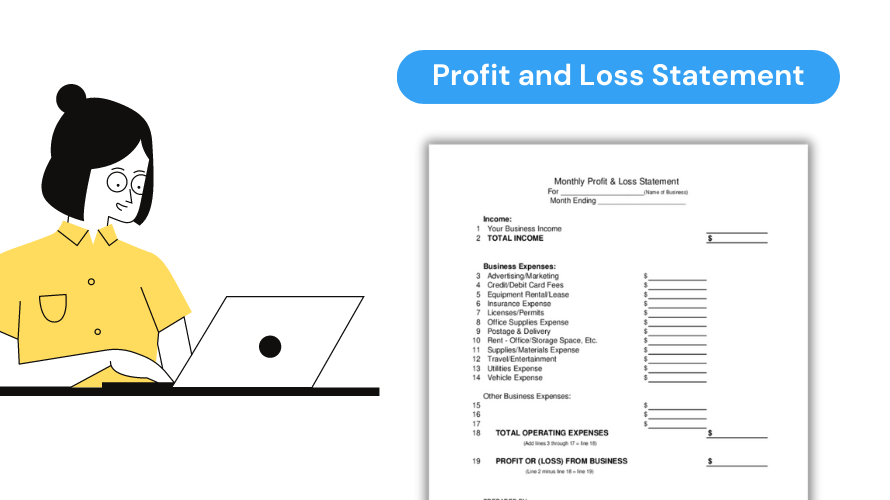

Understanding finance is crucial for any small business, and a Profit & Loss (P&L) statement stands out as one of the most significant financial documents. In essence, a small business profit & loss statement quantifies your company's revenues, costs, and expenses during a specific period. By detailed analysis of this document, business owners can gain clear insights into their financial health and implement strategic actions based on their profitability.

Possible Alternatives to the Profit & Loss Statement

Though it's highly recommended for small businesses to maintain a P&L statement, there are circumstances where alternatives might be used. For instance, a cash flow statement is sometimes preferred by startups or businesses that are more concerned with their liquidity position. Alternatively, a business might use a balance sheet for a 'snapshot' of its financial status at a particular point in time.

Profit & Loss Statement - Understanding Complicated Parts

Completing a P&L statement can seem daunting, but with the right guidance and a practical profit & loss statement template for small business, it becomes simpler. One of the main complexities lies in breakout sections for various expenses. A handy tip to navigate this is thoroughly reviewing the business’s financial transactions, ensuring that each expense is recorded under the correct section. Furthermore, business owners should always double-check their calculations to avoid errors that could fundamentally alter their P&L statement.

Profit & Loss Statement: Popular Questions

- Is it mandatory to file a P&L statement?

While it's not formally obligatory, your small business will inevitably need a P&L statement to understand its financial performance better and strategize for future growth. It varies depending on the country, the legal structure of the business, and its specific circumstances. - How frequently should a P&L statement be generated?

The frequency at which a Profit and Loss (P&L) statement should be generated can vary depending on the specific needs and circumstances of a business. Ideally, businesses should prepare the P&L statement every month to routinely monitor financial performance. However, a quarterly or annual statement might also suffice, depending on the business's requirements. - Where can I find a free profit and loss statement for a small business?

You are free to use our online platform, where we provide a handy, editable template for businesses. For newcomers, we also offer an example of the profit and loss statement for small business to assist in the process.

With careful management, the profit & loss statement for business can be an effective tool in gauging your company's success and implementing effective changes. With this knowledge, you can approach your business's finances more confidently and strategically.